sourcing ROI calculator [TOOL] #sosueu

Great companies starting their journey of building an in-house sourcing function are usually aiming for cost saving in the first place. This is the most regular answer they give when interviewing them: become less dependent of 3rd party agencies and thus to save cost on agency fees.

This is an obvious drive behind such a capability build although gaining a real financial advantage via sourcing is not that obvious.

There are some pretty traps here that corporations often accidentally fall into so I decided to gather them and share back with the community. Hope this will help some of you shape better (and more consciously) the sourcing journey.

TRAP NUMBER ONE: A good gang of experienced sourcers will indeed reduce the dependency of 3rd party agencies but they will also cost you some significant money. Return on investment, as learnt in the school, does mean that you need to first invest into something before gaining advantages.

The sourcing build investment will not only include salary cost but salary, bonus and other benefits, tooling, CRM cost, the fee of new job board databases and other licences. Usually, a sourcing function never comes alone with salaries only, but it is people, new tech and recruitment marketing cost, blended.

TRAP NUMBER TWO: You cannot gain more than what you’d normally spend… well, this relatively dumb statement has some wisdom in it. Cost saving, in case of reducing 3rd party agency cost, has threefold limitations:

- Recruiting is not free. It will always have a price so you either use agencies or start building an in-house sourcing function it will anyway cost you something. Zero is not a number in our business so set the right expectations.

- Reducing agency cost is a moving target. If your sourcing team functions well, year over year, you will save less and less. Not saying it is necessarily an issue but something you and your talent acquisition function may need to keep in mind. Gaining financial advantage will not always remain a highly visible achievement and your sourcing powerhouse can easily stop shining when reached the maximum of this fairly transactional measure.

- Be thoughtful before trying to eliminate all of your 3rd party agencies. Time may come when you still need to use some of them. Agencies will always be your best friend when you and your team cannot handle an assignment due to confidentiality or volume or hiring peak or any other specific reason. I believe it is safer to estimate some (little) 3rd party agency spend every year in the recruiting budget rather than going null and later regret.

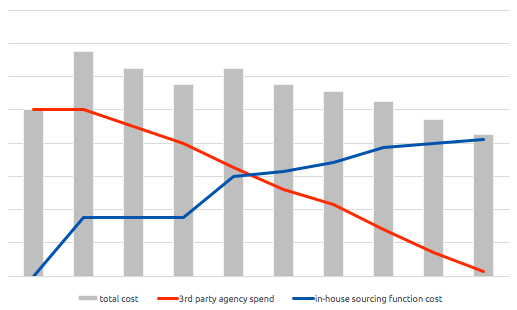

On the below chart I give a very generic visual on the above points. Red is the declining agency spend, the blue line is showing how the sourcing team’s cost usually grows.

Although an early breakeven point on such a chart may look promising the cumulative total cost (agency AND sourcing team cost, grey bars) is the right measure to check.

Three further remarks:

- During the build, the total cost usually grows temporarily higher than what it was before

- The end financial gain (last grey bar) may give only a tiny percent saving compared to the initial financial case (first grey bar). Again, be thoughtful when setting the expectations!

- As you see above, each time period (month, quarter etc.) may close with different total cost. Run a long-time ROI calculation to understand the real opportunities in the financial gain

TRAP NUMBER THREE: if you need to generate cost savings then use the sourcing engine to work on those positions where you spend extra money nowadays.

Be strict (or consistent) (or determined?) in assigning only those reqs to your sourcing team which create financial problems for your business. Although a good sourcer can support other reqs, too, and with that they may achieve quicker hiring procedures, better quality of shortlist etc., if you need to save cost and the sourcer’s capacity is booked (and fragmented) you both won’t have a chance to succeed. If money matters then make saving become your number one priority.

AND THE LAST ONE, TRAP NUMBER FOUR: as discussed above it can happen that after implementing an in-house sourcing team the financial advantage does not turn to be as attractive as previously expected. I have seen many cases when in-house sourcing was not seen as a primary money-saving function.

Sourcing has significantly more value propositions than cost saving only (think about talent pool building, gathering strategic market intelligence, mapping competitors just to name a few) and many of these cannot be directly linked to financials. Use the mindmap I have created some time ago to better identify the real business need vs. the sourcing service (and value) you need to provide.

If we think about the regular sales org for a second… as a sample… not everyone in the sales department is a money-maker. There are sales ops, sales support and all type of pre- and aftersales functions that are all linked to the commercial department although contributing little or null to direct revenue generation.

Maybe sourcing should be more seen in the future as these functions and for this, step one, is to try moving away from defining sourcing purely as a cost-based, transactional service line.

So what now?

In short, there are only three best advices:

- Make the right sourcing ROI calculation at the beginning of the journey and set the right expectations – use the tool below

- Once on-boarded the sourcing team (and you want to demonstrate cost saving) assign the sourcers against the right positions. Don’t waste anyone’s time (and money)

- Start early influencing your talent acquisition department that sourcing has other value propositions, too, and transactional financial metrics should not be the only ones in place

About THE sourcing ROI tool

The below tool is brought to help you calculate your potential financial gain in case of implementing an in-house sourcing function.

The four rows on the top reflect the case when there is not yet in-house sourcing function implemented in a company – please add data input to the light grey cells.

The rows below bring the financial case when already having a sourcing function. Here I still estimate some agency spend in this way: applying the given agency percent on (all reqs minus those that will be filled by the sourcer).

The last two rows show you either the savings (positive values) or the investment (negative values). ROI percent is calculated against the current case.

Feel free to play around with this tool, modify the numbers per your business case. Google tells me it is protected enough so you won’t be able to break it.

Or who knows?… if still reading this, you must be a badass good sourcer so only God knows what you are really capable of? 😉 happy sourcing, my friend!

Responses